How Much Is Tax On Furniture In Missouri . missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. Local tax rates in missouri range from 0% to 5.875%, making the sales. the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. Enter your street address and city or zip code to view the sales and use tax rate information for. you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. how much is sales tax in missouri? 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. find sales and use tax rates. The base state sales tax rate in missouri is 4.23%.

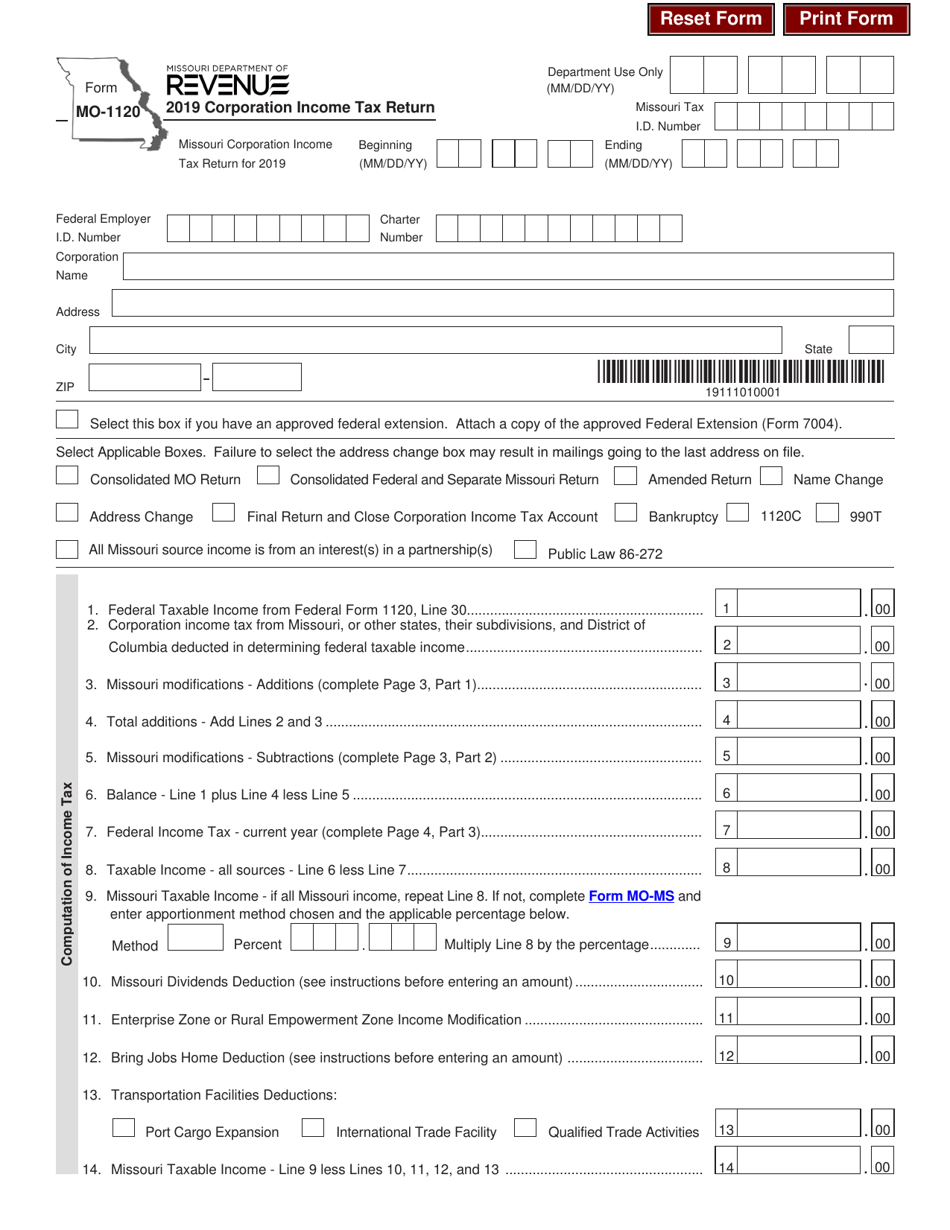

from www.templateroller.com

Enter your street address and city or zip code to view the sales and use tax rate information for. find sales and use tax rates. Local tax rates in missouri range from 0% to 5.875%, making the sales. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. how much is sales tax in missouri? 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. The base state sales tax rate in missouri is 4.23%. missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer.

Form MO1120 Download Fillable PDF or Fill Online Corporation

How Much Is Tax On Furniture In Missouri 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. how much is sales tax in missouri? Local tax rates in missouri range from 0% to 5.875%, making the sales. you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. find sales and use tax rates. Enter your street address and city or zip code to view the sales and use tax rate information for. The base state sales tax rate in missouri is 4.23%.

From epicofficefurniture.com.au

Can I Claim Office Furniture on My Taxes? What You Need to Know How Much Is Tax On Furniture In Missouri Enter your street address and city or zip code to view the sales and use tax rate information for. missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. how much is sales tax in missouri? Local tax rates in missouri range from 0% to 5.875%, making the sales. the missouri department of. How Much Is Tax On Furniture In Missouri.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up. How Much Is Tax On Furniture In Missouri.

From marylqmadelyn.pages.dev

Missouri Tax Rate 2024 Pru Leelah How Much Is Tax On Furniture In Missouri how much is sales tax in missouri? this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. missouri broadly taxes sales and purchases of tangible personal property. How Much Is Tax On Furniture In Missouri.

From emaqvalene.pages.dev

Missouri State Tax Rate 2024 Yoshi Maegan How Much Is Tax On Furniture In Missouri the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. Enter your street address and city or zip code to view the sales and use tax rate information for. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up. How Much Is Tax On Furniture In Missouri.

From www.missourifurniture.com

Missouri Furniture Better Quality, Best Price, Guaranteed How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. The base state sales tax rate in missouri is 4.23%. missouri broadly taxes sales and purchases of tangible personal property (goods),. How Much Is Tax On Furniture In Missouri.

From mobudget.org

Missouri Budget Project How Missouri Taxes & Revenue Compare to Other How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. The base state sales tax rate in missouri is 4.23%. Local tax rates in missouri range from 0% to 5.875%, making the sales. the missouri department of revenue administers missouri's business tax laws, and collects sales and. How Much Is Tax On Furniture In Missouri.

From polstontax.com

Missouri Sales Tax Guide for Businesses Polston Tax How Much Is Tax On Furniture In Missouri the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. find sales and use tax rates. missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. how much is sales tax in missouri? this free, online guide covers managing missouri sales tax compliance, including. How Much Is Tax On Furniture In Missouri.

From www.templateroller.com

2021 Missouri Tax Chart Fill Out, Sign Online and Download PDF How Much Is Tax On Furniture In Missouri find sales and use tax rates. Local tax rates in missouri range from 0% to 5.875%, making the sales. how much is sales tax in missouri? you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. this free, online guide covers managing missouri sales tax. How Much Is Tax On Furniture In Missouri.

From www.salestaxhelper.com

Missouri Sales Tax Guide for Businesses How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. how much is sales tax in missouri? the missouri department of. How Much Is Tax On Furniture In Missouri.

From interioravenue.net

Guide To Office Furniture Taxes How Much Is Tax On Furniture In Missouri missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. Local tax rates in. How Much Is Tax On Furniture In Missouri.

From maxieydanyette.pages.dev

2024 Tax Rates And Deductions U/S Rikki Sapphire How Much Is Tax On Furniture In Missouri how much is sales tax in missouri? the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. The base state sales tax rate in missouri is. How Much Is Tax On Furniture In Missouri.

From www.missourifurniture.com

Missouri Furniture Better Quality, Best Price, Guaranteed How Much Is Tax On Furniture In Missouri missouri broadly taxes sales and purchases of tangible personal property (goods), with some exemptions. this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. The base state sales tax rate in missouri is 4.23%. find sales and use tax rates. the missouri department of revenue administers missouri's business tax laws, and. How Much Is Tax On Furniture In Missouri.

From www.missourifurniture.com

Missouri Furniture Better Quality, Best Price, Guaranteed How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. find sales and use tax rates. how much is sales tax in missouri? the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. Local tax rates in missouri. How Much Is Tax On Furniture In Missouri.

From www.missourifurniture.com

Missouri Furniture Better Quality, Best Price, Guaranteed How Much Is Tax On Furniture In Missouri how much is sales tax in missouri? find sales and use tax rates. you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. The base state sales tax rate in missouri is 4.23%. this free, online guide covers managing missouri sales tax compliance, including business. How Much Is Tax On Furniture In Missouri.

From jocelinewsuki.pages.dev

Missouri Tax Bracket 2024 Xenia Karoline How Much Is Tax On Furniture In Missouri Local tax rates in missouri range from 0% to 5.875%, making the sales. The base state sales tax rate in missouri is 4.23%. you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. how much is sales tax in missouri? 1033 rows missouri has state sales. How Much Is Tax On Furniture In Missouri.

From www.urban95.com

Tax Deductions for Office Furniture and Home Offices Urban 95 How Much Is Tax On Furniture In Missouri you can use our missouri sales tax calculator to look up sales tax rates in missouri by address / zip code. find sales and use tax rates. Enter your street address and city or zip code to view the sales and use tax rate information for. how much is sales tax in missouri? 1033 rows missouri. How Much Is Tax On Furniture In Missouri.

From www.missourifurniture.com

4 Big Offers Missouri Furniture How Much Is Tax On Furniture In Missouri 1033 rows missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. how much is sales tax in missouri? this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. The base state sales tax rate in missouri is 4.23%. . How Much Is Tax On Furniture In Missouri.

From polstontax.com

Missouri Sales Tax Guide for Businesses Polston Tax How Much Is Tax On Furniture In Missouri this free, online guide covers managing missouri sales tax compliance, including business registration, collecting tax. the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer. Enter your street address and city or zip code to view the sales and use tax rate information for. 1033 rows missouri has state sales. How Much Is Tax On Furniture In Missouri.